pay utah property tax online

You may also pay with an electronic funds transfer by ACH credit. Salt Lake County hopes that you find paying your property taxes online a quick and simple process.

Online payments may include a service fee.

. Here you can pay your personal property taxes. Pay For My Personal Property Taxes. General Election Results are scheduled to begin posting online on Tuesday November 8 2022 at 845pm Mountain Time.

Weber County property taxes must be brought in to our office by 5 pm. If paying after the listed due date additional amounts will be owed and billed. If paying after the listed due date additional amounts will be owed and billed.

Visit httpsbbmptaxkarnatakagovin to access the BBMP property tax online portal and BBMP Property Tax System. Pay for your Utah County Real Property tax Personal Property tax online using this service. Have your account number handy.

You can conveniently pay your real property taxes personal property taxes and mobile home taxes online. These are the payment deadlines. Be Postmarked on or before November 30 2022 by the.

This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. Washington County Treasurer 197 East Tabernacle St.

Online REAL Estate Property Tax Payment System. Go to Property Tax Lookup. We have arranged with Instant Payments to offer this service to.

Mdolancoweberutus Personal Property Appraisers Office. File electronically using Taxpayer Access Point at. Before continuing please make sure that you.

Please note that for security reasons. Enter the SAS Application Number or. Call 435 214-7550 to use our automated phone service.

Personal Property Admin Office. Please note that our offices will be closed November 24 and November 25 2022. You will need to enter your 8 digit UPP number to gain.

Use your property tax or utility account details to enrol in eBilling. Click here to view current results. Continue paying through your bank or mortgage company.

30 and many Utahns will have a bigger bill to pay after dozens of municipalities statewide voted to. E-checks are free credit cards 265 convenience fee. Acceptable forms of payment via mail are check cashiers check or money order.

7703 or by sending in form TC-804 Individual Income Tax. You may pay your tax online with your credit card or with an electronic check ACH debit. The link will take you to the pay portal in the County Assessors Office.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. You may request a pay plan for individual income tax online at taputahgov or over the phone at 801-297-7703 800-662-4335 ext. Property Taxes may be.

Pay for your Utah County Real Property tax Personal Property tax online using this service. Step 1 - Online Property Tax Payments. Pay by phone.

Call 801-980-3620 Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. View bills on Torontoca. See also Payment Agreement Request.

Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. SOUTH SALT LAKE Utah Property taxes are due in Utah on or before Nov. If I select payment by Credit Card or Debit Card I authorize the Salt Lake County Treasurer andor any third party the County may designate to charge my Credit Card or Debit Card account to.

On November 30 or 2. A processing fee will be charged for all online payments paid via debit or credit card of 25 of the transaction with a.

Utah Division Of Real Estate 1031 Exchange Addendum Fill Out Sign Online Dochub

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Pay Property Tax Summit County Ut Official Website

Pay Property Tax Summit County Ut Official Website

Utah State Tax Commission Official Website

2022 Property Taxes By State Report Propertyshark

Clark County Indiana Treasurer S Office

Official Site Of Cache County Utah Paying Property Taxes

Johns Creek Learn Tips On How To Pay Property Taxes In Johns Creek

How Long Can You Go Without Paying Property Taxes In Utah

Taxes Due Overlapping Boundaries Result In Higher Charges Deseret News

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Faqs Summit County Ut Civicengage

Property Tax Calculator Estimator For Real Estate And Homes

Are There Any States With No Property Tax In 2022 Free Investor Guide

Faqs Summit County Ut Civicengage

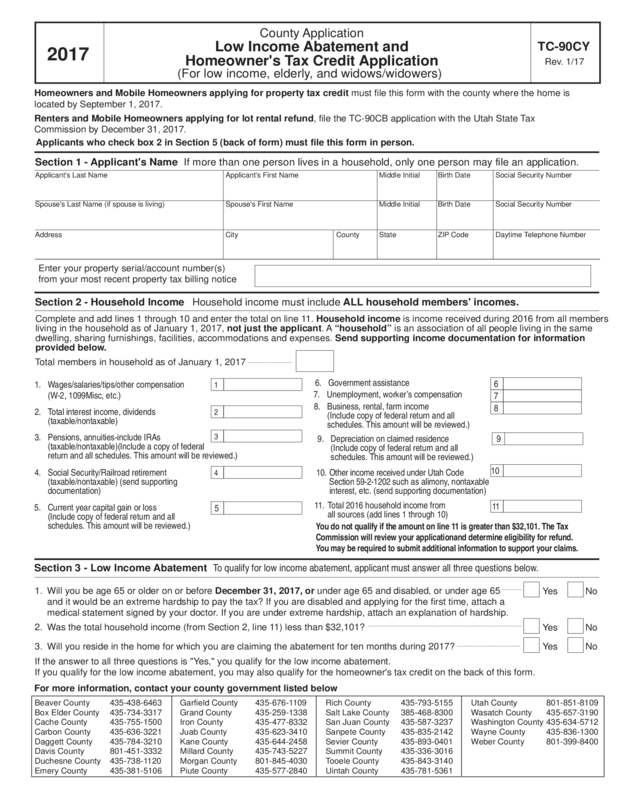

Tc 90cy Utah State Tax Commission Edit Fill Sign Online Handypdf